Thank you very much for your past donations.

Did you know that you can claim a 33.3% tax rebate for your donations of $5 or over and can be donated back? Claiming your tax and donating it to the Sisters is a great way to make your donation go further.

For example, if you donate $100 you are eligible to claim a $33 tax rebate. Donating this tax rebate to the Sisters of Compassion makes your gift worth $133.

How can I claim a tax rebate and donate it to the Sisters of Compassion?

If filing by paper:

1. After 31st March, download and print the IR526 form.

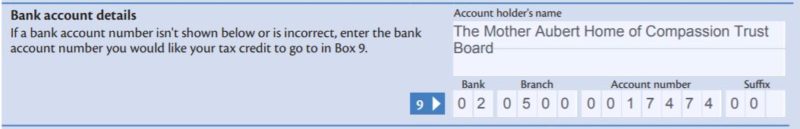

2. In BOX 9 of this form, enter the name “The Mother Aubert Home of Compassion Trust Board” and the bank account details 02-0500-0017474-00. Please see below for an example:

3. Staple your donation receipts to the back of the form.

4. Send your completed IR 526 form with donation receipts to Inland Revenue Department, PO Box 39090, Wellington Mail Centre, Lower Hutt 5045.

5. Please email donations@compassion.org.nz or phone 04 383 7769 with your name and IRD number so that we can identify and thank you for your gift.

If filing online, in a myIR account:

Visit ird.govt.nz/donations for more information.

Already received your tax rebate?

1. Donate by internet banking

To: The Mother Aubert Home of Compassion – Trust Board, Account number: BNZ 02-0500-0017474-00.

Enter your name, supporter number (optional), and ‘tax rebate’ in the reference fields.

Email or phone us to advise us of your donation.

2. Donate online at: compassion.org.nz/support-us/donate

Please write ‘Tax rebate donation’ in the ‘Would you like to leave a message?’ box.

Can I get a receipt from the Sisters of Compassion?

Yes, we can provide you with a tax-deductible receipt for your rebate. Email us at donations@compassion.org.nz or phone 04 383 7769 with: your name, IRD number, address, and the amount transferred (Inland Revenue does not provide us with name and address details).

We will receipt these funds in your name when they arrive, enabling you to claim a further tax credit next year.